Average Cost Of Life Insurance For 60 Year Old Female

Affordable life insurance rates at 60 69 years old we specialize in helping people purchase affordable term life insurance especially those who are between the ages of 60 to 69.

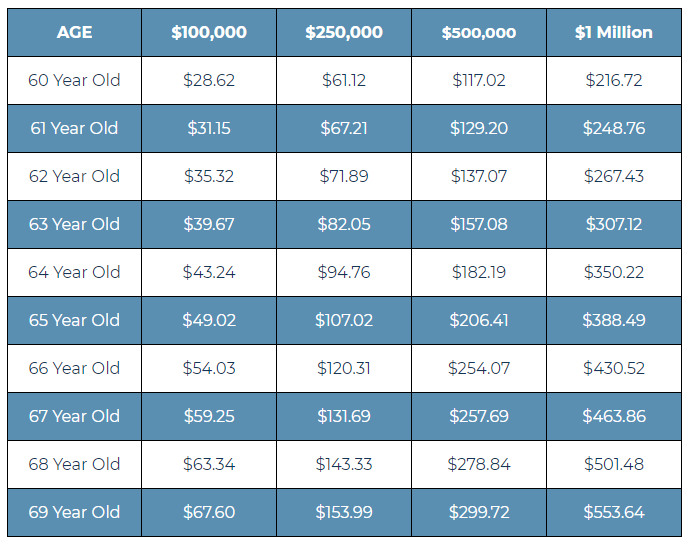

Average cost of life insurance for 60 year old female. It will offer a level premium for 10 years. You will find rates for varying amounts and term lengths. To see term life insurance tables for 60 year old men and women scroll about halfway down the page. By waiting 20 years until age 50 rates for a 20 year 500 000 term life policy will more than triple.

Let s look at a 59 year old nonsmoking woman. You ll skip the medical exam in exchange for higher rates and lower. If we look at the same policy for a 59 year old nonsmoking woman the average cost is around 148 49 a month or 1 781 88 a year. A 10 year term policy usually has the lowest rate.

Not as large as alaska or wyoming but still a lot especially as a person gets older for someone who is 60 the rate is. Life insurance companies will use age as a determinant for life insurance premiums. For a 59 year old nonsmoking man in perfect health the typical cost for a 500 000 20 year term life policy is 231 80 a month or 2 781 60 a year. A 20 year 500 000 term life insurance policy will cost about 100 more per year.

Use our comparison tool for a personalized quote. 10 year term life insurance rates by age. These life insurance rates are for a healthy 50 year old male. Health insurance companies determine the set of policies offered and the cost of coverage based on.

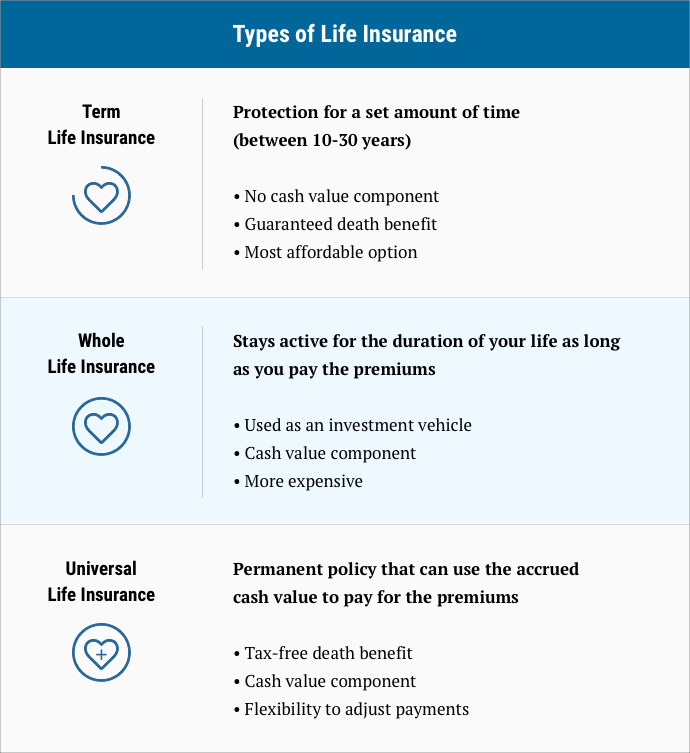

The term life insurance quotes below are for a 20 year term life insurance policy with a death benefit of 500 000. The health care cost per person covered by a policy will be set according to their age with rates increasing as the individual gets older children up to the age of 14 will cost a flat rate to add to a health plan but premiums typically increase annually beginning at age 15. It s possible to get life insurance after 70 but your options will be limited and you can expect to pay substantially more for coverage a person in their 80s can expect to pay more than 1 000 a year for a 10 000 or 20 000 final expense or guaranteed issue policy. You will get a guaranteed level premium for 20 years and once the 20 year term is up your premiums will rise annually if the policy is renewable.

An older male can expect higher rates. 20 year term life insurance quotes with exam a 20 year term policy usually the middle range of pricing. Although knowing the questions to ask is the hard part. Rates will continue to increase as you age due to a decrease in your total life expectancy.

Cost of life insurance for people over the age of 70.