Average True Range Percentage

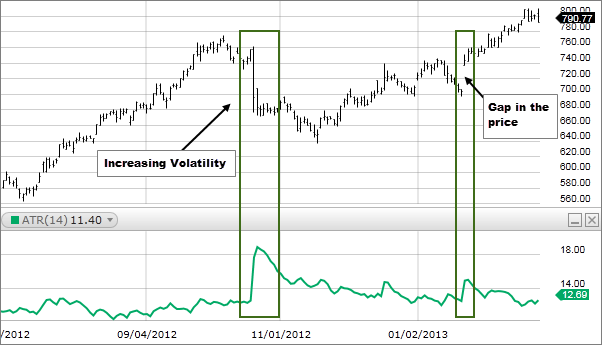

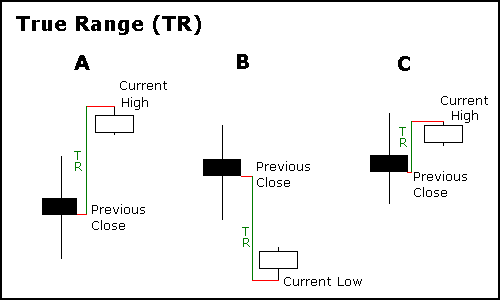

Atr measures volatility taking into account any gaps in the price movement.

Average true range percentage. Description average true range percent atrp expresses the average true range atr indicator as a percentage of a bar s closing price. It is typically derived from the 14 day moving average of a series of true range indicators. Typically the atr calculation is based on 14 periods which can be intraday daily weekly or monthly. The 14 day atr is the average of the daily true range values for the last 14 days.

Average true range atr is a technical indicator measuring market volatility. How this indicator works. The average true range formula looks as. Moving average envelope mae moving average envelopes are lines plotted at a certain percentage above and below a moving average of price.

To form the beginning the first true range value is calculated as the high minus the low. The average true range percent is the classical atr indicator normalized to be bounded to oscillate between 0 and 100 percent of recent price variation. Atrp allows securities to be compared where atr does not. As is it average true range of an instrument can be easily compared to any other because of absolute percentage variation and not prices itselves.

Atrp is used to measure volatility just as the average true range atr indicator is. To measure recent volatility use a shorter average such as 2 to 10 periods. Usually the average true range atr is based on 14 periods and can be calculated on an intraday daily weekly or monthly basis.

:max_bytes(150000):strip_icc()/ATR-5c535f8fc9e77c000102b6b1.png)

:max_bytes(150000):strip_icc()/close-up-of-man-hand-analyzing-stock-market-chart-1023021802-e5e288d56a9d412c8aa31cc6d908910b.jpg)