Back Door Roth Ira Conversion 2017

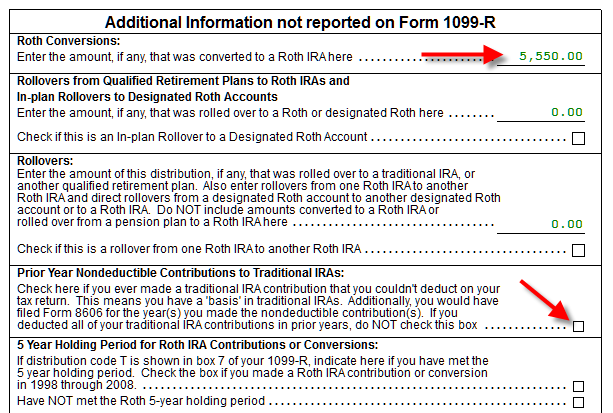

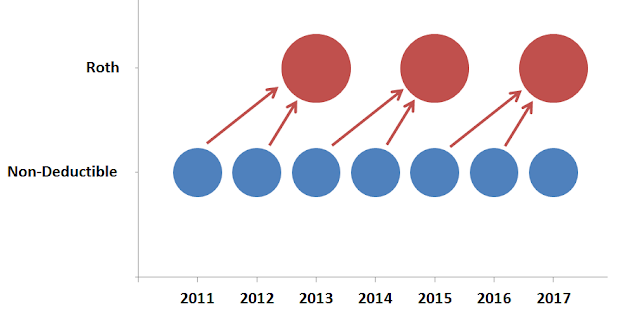

This is post tax ira for backdoor roth conversion.

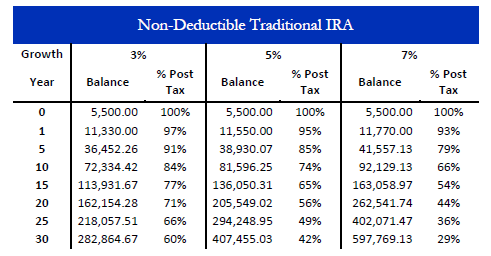

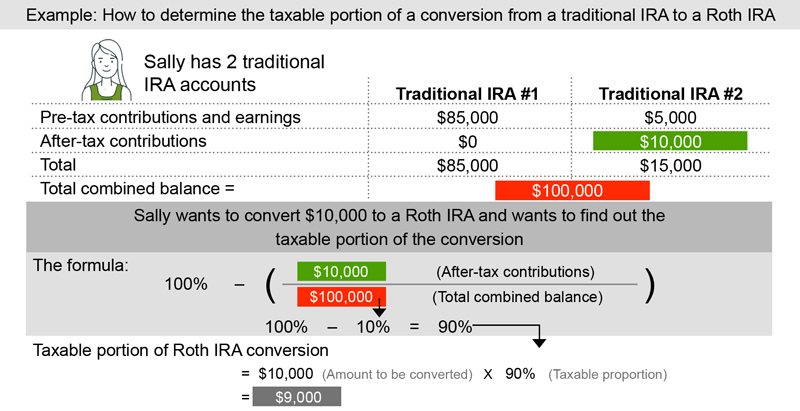

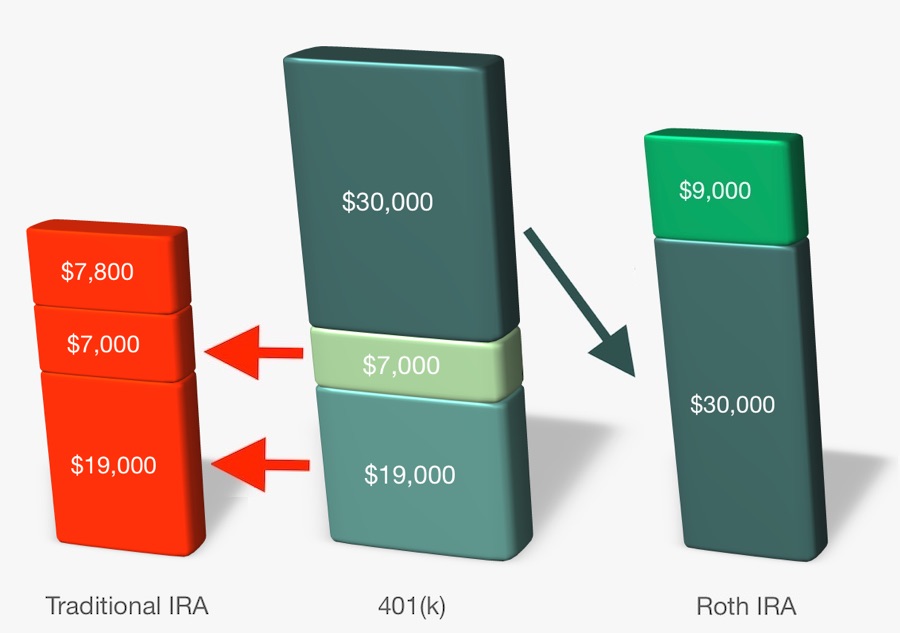

Back door roth ira conversion 2017. A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions. You should contribute directly to a roth ira and avoid the backdoor conversion if your magi is below a certain amount. For example if your traditional ira balance is 20 000 after rolling over money from a 401 k and 2 000 is from nondeductible contributions only 10 of any conversion to a roth will be tax free. The conversion is reported on form 8606 pdf nondeductible iras.

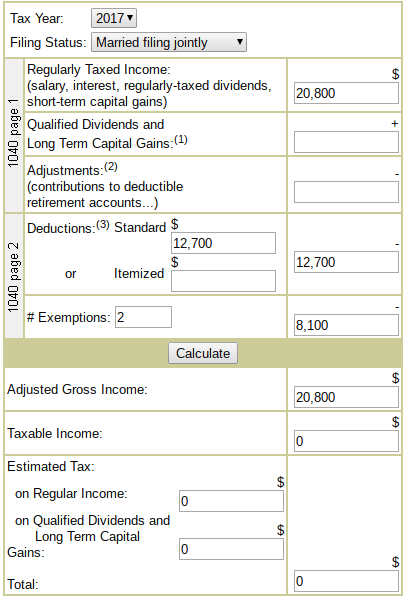

A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira. When i imported 1099 r from my broker my owed tax amount went significantly high for 5500 contribution. First place your contribution in a traditional ira which has no income limits. But make sure you understand the tax consequences before using this strategy.

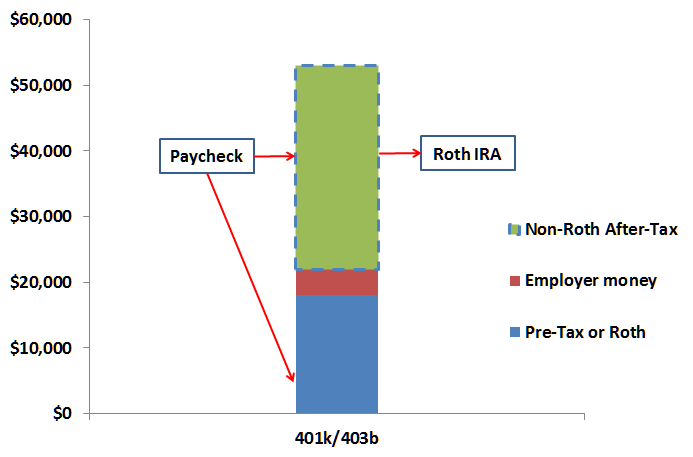

The 2020 tax year income limits are 124 000 for singles and 196 000 for. Or because i had a private ira for the calendar year of 2017 i am not eligible for a back door roth. Then move the money into a roth ira using a roth conversion. Is there any special steps to follow to have this reported correctly i am planning to do the same contribution for 2017 before filing my return p p thanks p.

More the complete guide to the roth ira. Can you please elaborate on this edge case. For instance if i roll my private ira into a company 401k today 1 11 2018 will i be able to star the back door roth strategy once that roll over is done guessing around 1 18 2018. See publication 590 a contributions to individual retirement arrangements iras for more information.

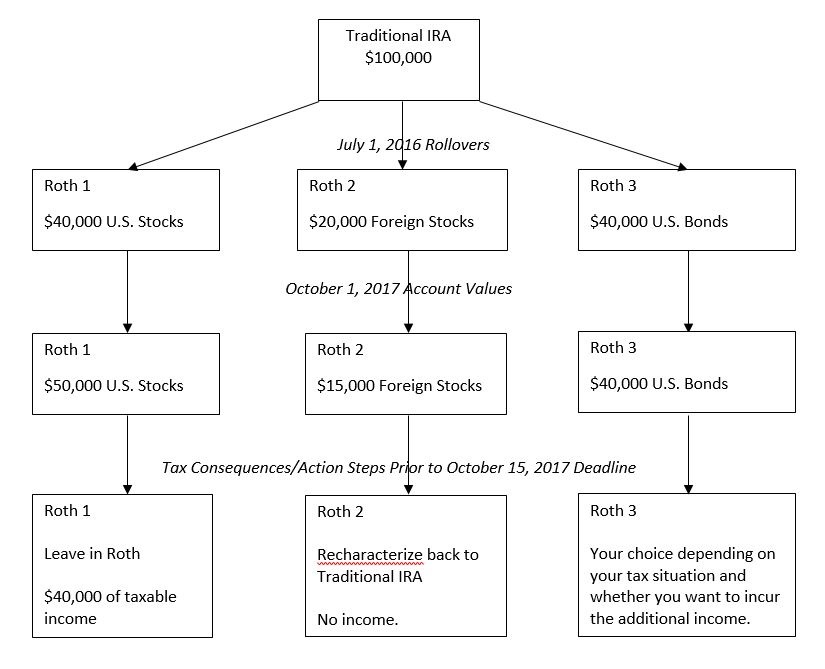

The backdoor roth ira contribution is a strategy and not a product or a type of ira contribution. The conversion would be part of a 2 step process often referred to as a backdoor strategy. Why would i have to pay tax if this is a post tax contribution. Return to iras faqs.