Backdoor Roth Ira Conversion Deadline

For instance you are eligible to make a regular contribution to a traditional ira for 2019 only if you will not reach age 70 on december 31 2019.

Backdoor roth ira conversion deadline. Backdoor roth conversion for 2018 in 2019. In most years that magic date is april 15. You are considered to have reached age 70 six. If you haven t filed your taxes for 2019 yet you have until.

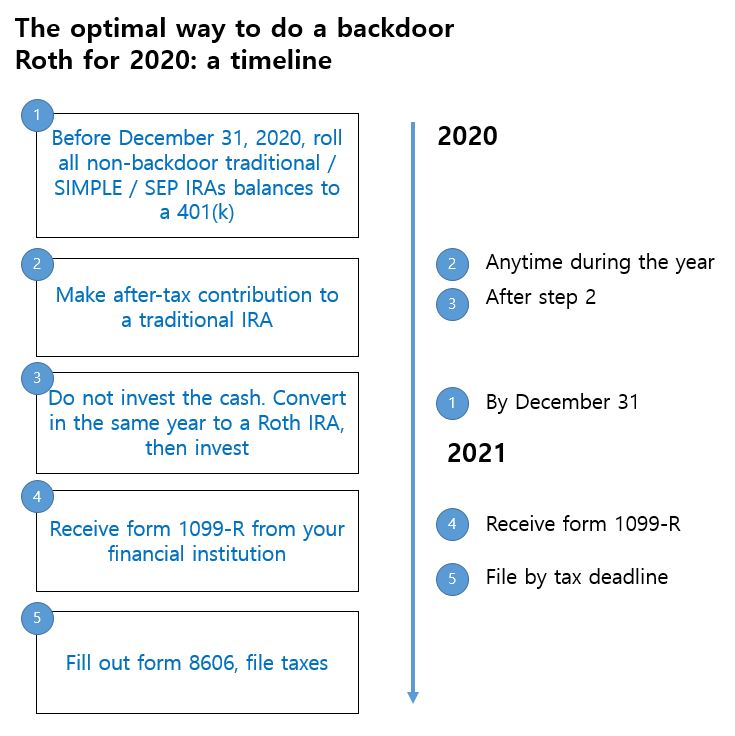

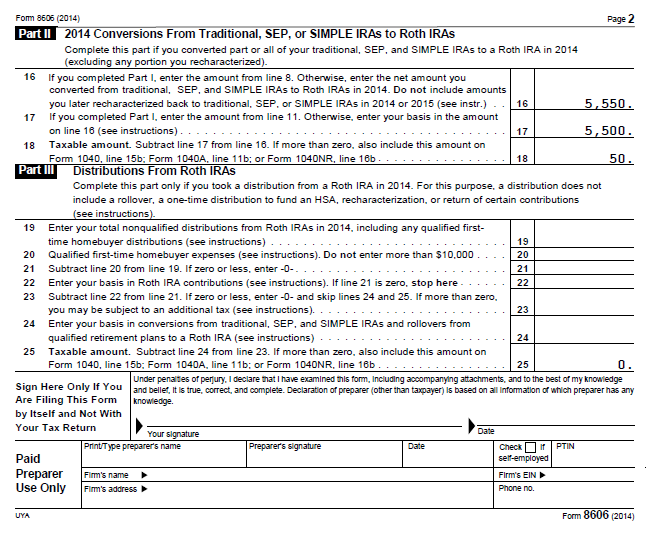

You can convert your traditional ira to a roth ira by. It will be reportable on your 2018 form 8606. If you ve decided on a roth ira conversion for your existing retirement account you can get started on your own or have one of our investment professionals help you every step of the way. Look for the dropdown menu in the lower right labeled i want to and select convert to a roth ira.

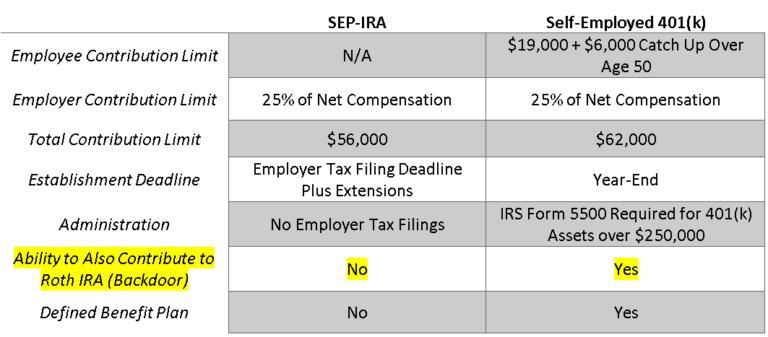

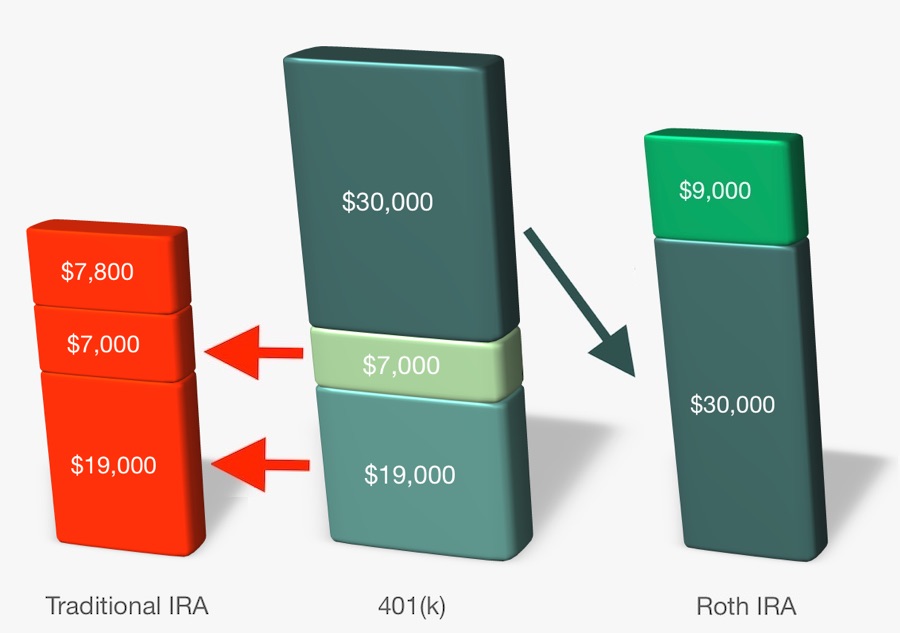

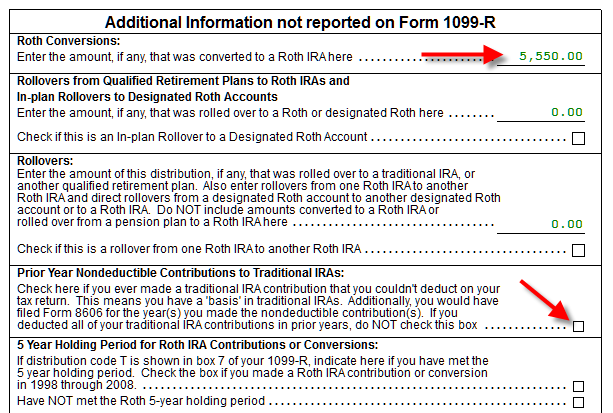

The net effect of the backdoor roth ira contribution is that the conversion eliminates the ability to make deductible ira contributions. Two important annual deadlines are the roth ira conversion deadline december 31 and the deadline for contributions to an ira the due date for filing taxes around april 15 of the next year with. December 31 2019 for the 2019 tax year. Rollover you receive a distribution from a traditional ira and contribute it to a roth ira within 60 days after the distribution the distribution check is payable to you.

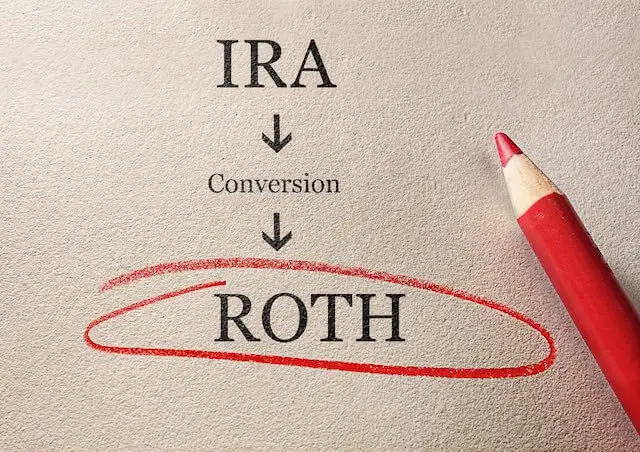

From there a roth ira conversion takes place letting those high income investors take advantage of tax free growth and future distributions without having to pay income taxes later on. If you had sufficient compensation in 2018 to support a 5 500 contribution for 2018 yes you can make a 5 500 nondeductible traditional ira contribution for 2018 by april 15 2019. A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions. Presumably you are well under age 70.

A backdoor roth ira can make sense in the same scenarios any roth ira conversion makes sense. If you ve got an eligible spouse and by eligible i m referring to backdoor roth eligibility the two of you can sneak 24 000 into roth accounts this year as long as you complete the 2019 contribution by mid april 2020.

.jpg?width=400&name=Artboard%204%20(2).jpg)

:max_bytes(150000):strip_icc()/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg)